The allure of the shiny metal card is hard to beat — and so is 5x points on airline purchases when you’re a frequent flyer. But recent changes and experiences made the AmEx Platinum $695 annual fee hard to justify, especially when there are less expensive and more convenient cards out there. If you’re on the fence about keeping your AmEx Platinum or just curious about what cards provide the most value, read on to learn from my experiences. Note that I am not discussing sign-up bonuses, this is about the value of these cards year after year.

These are my own personal experiences I am sharing from many years of travel to help you make the best decisions to plan your next adventure. Points and miles, if used wisely, are a great way to add comfort to your journey and make your travel budget go even further.

The Diminishing Benefits (For Me)

The key to selecting a premium credit card is making sure you’re getting more value than the cost of the annual fee. In prior years, I easily erased the AmEx Platinum’s $695 fee with the credits the card provides, so points accumulation and lounge access were just added “free” perks. But here’s why this is no longer true for me – remember this is a very individual assessment:

Overcrowded Lounges: I was really excited to access the AmEx exclusive Centurion lounges, but they were so crowded that we left for other Priority Pass lounges almost every time. While Centurion is only available through AmEx, Priority Pass is a perk of many premium cards. To combat overcrowded lounges, AmEx hiked up the annual fee to add authorized users, which wasn’t worth it for us, since our three home airports in Washington, D.C., do not have a Centurion lounge. We have another card that allows additional authorized users for free (more on that below). Also, while access to Delta lounges (only when flying Delta) is a great perk, Delta is not very competitive in our market, so we rarely fly with them.

Complicated Credits: Recouping the cost of the annual fee through credits takes some dedication because you have monthly, semi-annual, and annual credits available. Here are some that I took advantage of and why they may or may not work for me anymore:

- Monthly Uber Credit. This totals $200 a year if you use Uber or Uber Eats every month. I find that Uber Eats is way overpriced compared to DoorDash, so I’m not really getting value from that $15/month, and I have more Lyft perks anyway for ride-share, so I only use Uber abroad or when it’s cheaper than Lyft.

- Semi-Annual Saks Fifth Avenue Credit. You get $50 twice a year at Saks, and I used this to buy mascara – because the key to getting value out of these benefits is that you would’ve been spending this money anyway, even if you didn’t have the card perk. But I don’t have a Saks nearby, so I either had to pay shipping or spend $100 each time, which totally took away the value of this perk.

- Annual Airline Credit. The $200 airline credit for incidentals (not airfare) is great, but you have to designate one and only one airline every year. If you already have perks through elite status (like free extra space seats and lounge access) you’ll want to designate an airline that you don’t fly with as often. I used it for JetBlue last year and recouped only $155 for seats and drinks onboard). You can be smarter about this to ensure you get the full $200 but sometimes it’s hard to predict at the start of the year.

- Annual CLEAR Membership (up to $189). I would not have signed up for CLEAR if it wasn’t a benefit of the card so I can’t really add this to the calculation. Also, CLEAR lines have taken longer than regular TSA lines probably 7 out of 10 of my latest trips. It’s nice to have but not really worth it lately. And my AmEx Hilton Aspire just added this benefit, so I don’t need it from the Platinum anymore.

- Monthly Digital Entertainment Credit. This $20/month ($240) credit totally works for me because it applies to Disney Plus, which I already had. You can see if it applies to something you already purchase each month to see if it has value for you.

- Hotel Credit. This $200 never had value to me because I book less expensive properties and the credit doesn’t make up the difference. Also, the AmEx portal sometimes has way higher prices than booking direct or through another portal.

- Other Credits. I’m sure the monthly Walmart+ credit ($155 annually) is valuable to many people, but we don’t use it. Overall, AmEx boasts a $1,500 annual value, but the actual worth is very individual, and you’ll need to explore what works for you. I was getting about $640 in credits if I used all the Uber and airline allotment. That’s not bad at all, especially if I can also access lounges and redeem points for travel. But that leads me to my next point.

Limited Bonus Points. While the 5x points for flights purchased directly through airlines is huge, you don’t get additional bonus-point spending categories like you do for other cards (other than through the AmEx booking portal, but the hotel prices are generally higher than other sites, and I rarely book airfare through portals. That could be the subject of another blog post!) Also, as I’ll discuss below, the 3x points with Chase Sapphire Reserve gives me so much value when transferring to Hyatt, it makes up the difference.

Better Options Elsewhere. I will miss Marriott Gold status, but I get Hilton Diamond status and Hertz Gold with other cards, so some additional benefits of this card are a wash for me. The premium travel card game has become pretty competitive lately and there are lots of options to suit your needs. If you’re really into the points and miles game and have a ton of flexibility on when and where you travel, then the transfer value of AmEx points (to partner airlines and hotels) is going to be greater than some of the options I discuss below. But my goal was to simplify my personal points and miles programs while still getting great value. I’ll discuss my favorite options below after trying out 12+ travel cards.

My Favorite Travel Card Combo

Capital One Venture X

In the past when I heard people rave about the Capital One Venture X premium travel card, I didn’t understand all the hype, since other cards have bigger bonus-point options and better transfer partners.

I finally decided to get this card because Capital One opened a gorgeous lounge at Washington Dulles airport – and it’s located right after security, so you can easily visit even if you’re flying out of the dreaded C and D terminals. The Venture X quickly became my favorite card. In fact, if I could only have one card, this would be it. Here’s why:

- The $395 Annual Fee Is the Easiest to Justify and Recoup. This card gives you a $300 annual travel credit and 10k bonus points (worth $100) each year. So, there’s your $400 back! You must book the $300 travel credit through their portal, but the portal has lots of air and hotel options, comparable prices to other portals and direct booking options, and a price match guarantee. The portal also allows you to use a combination of cash, credits, and points. So, for example, we booked a $400 2-night stay in Helsinki using the $300 credit and 10k points. We were going to book this anyway at the same price, so this makes all the other perks of the card “free” for the rest of the year.

- You Get 2x Points on Every Single Purchase. While many cards offer higher bonus-point categories, you only get 1 point per dollar on all other purchases with those cards. This card is great because you don’t have to do any planning or calculations, you just get 2 points for every dollar spent. Simple. You do get extra points for purchases through the portal, but like I said, I rarely ever do this unless it’s to redeem points and credits.

- You Get Priority Pass, Plaza Premium, and Capital One Airport Lounge Access. This works great for us because we have lots of Priority Pass options and a Capital One lounge at Dulles.

- Authorized Users Are Free to Add. Up to four authorized users are free, and they get their own lounge access! So, this is great for couples and families.

- You can apply your points retroactively to travel bookings like Airbnb. This is such an awesome perk for people like me who use Airbnb a lot or prefer to book directly with hotels and airlines. For purchases categorized as “travel,” you can charge the expense directly to your card and apply the points post-purchase at a value of 1 cent per point. So you’ll use 10,000 points for a $100 travel purchase. While this is not the best redemption rate, it is easy and applies to the whole travel category. We’ve used this for tours, ground transportation, accommodations, and flights. AmEx offers a “pay with points” option but at a much lower value.

- You get Hertz Gold Status. We don’t rent cars often but plan to check out this perk later. I never used this on Amex because I rarely drive. But with Venture X, the hubby gets this benefit for free as an authorized user, so we plan to explore this option later this year.

Chase Sapphire

[UPDATE: Chase Sapphire Preferred significantly changed their benefits and hiked their annual fee to $795 beginning Oct. 26, 2025. While the Preferred still holds the same value, we’ve adjusted our strategy. Read all about our new plan and the new benefits here.]

Chase Sapphire Preferred ($95 annual fee) and Chase Sapphire Reserve ($550 annual fee) are two of the best cards out there – and I keep my CSR to get some perks the Venture X doesn’t offer. Even though Capital One has a bunch of airline and hotel transfer partners, I didn’t mention them above because I don’t use them (but you might!). Here’s how I use the Chase Sapphire Reserve to fill in the gaps and justify the hefty $550 fee:

- The Best Transfer Partners. I can’t give up my Chase card because you can transfer points to Southwest, United, and Hyatt. In addition to Hilton, these are the brands I use most, and my other cards don’t offer transfers to them.

- Easiest Annual Travel Credit. Your annual fee is automatically reduced to $250 when you spend at least $300 on the card in the “travel” category. This is automatically applied to the first $300 in travel you purchase and is applied to a broad category including ride-share services and road tolls. You don’t have to do anything but charge to the card to get this perk.

- 3x Points on travel and dining purchases. I love that these categories are super broad, so you can easily accumulate points even just from taking a ride-share, paying tolls, or stopping at Starbucks. As for airfare, even though I’m losing my 5x points with AmEx, I’m getting the most amazing transfer partner (below), which means my 3x points go further.

- All Hail Hyatt. I will cry the day Hyatt turns to dynamic pricing like its competitors. For now, however, Hyatt has fixed peak and off-peak points redemptions for their properties based on their category (luxury down to Category 1 for budget properties). The points redemption is so good, in fact, that I thought it was an error the first time I tried to redeem. Here are a few examples (with fictitious dates):

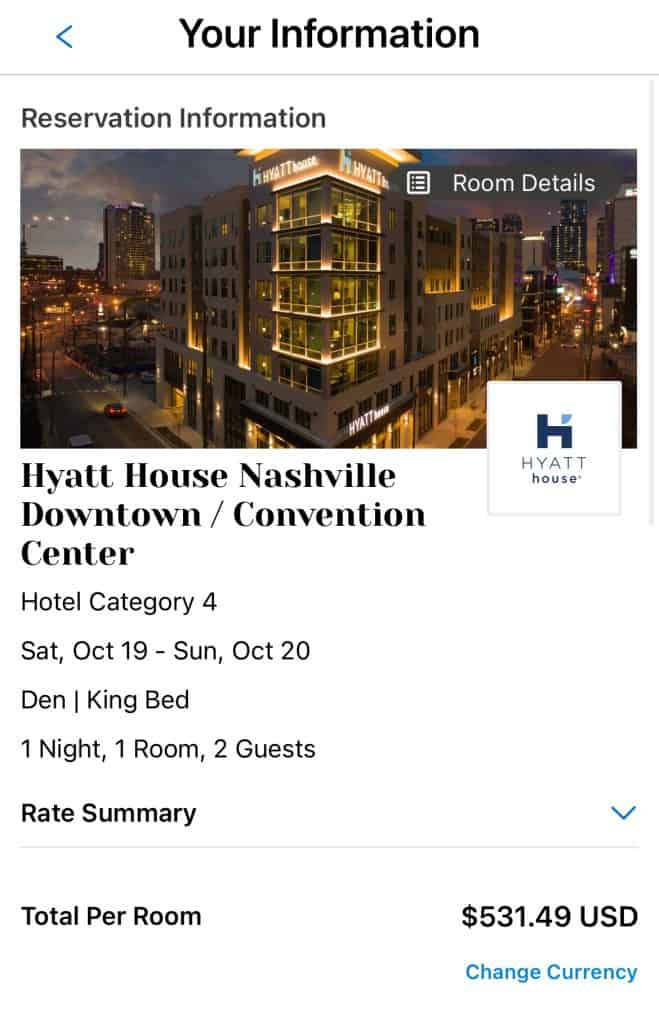

This $200 airport hotel is only 5,000 Hyatt points

This $500 room is only 18,000 Hyatt points

So, get ready for a little travel math. Basically, I get nearly $200 of value every time I spend 5,000 points on a Category 1 airport hotel (which I do frequently) – and over $500 in value for 18,000 points on a Saturday night in Nashville (which is super expensive if you want to stay close to Lower Broadway, so I always use points). That means charging less than $650 a month in the travel and dining categories on this card will get me the points to cover these two stays in a year. That’s $700 in value for these two points redemptions alone. Subtract the remaining $250 annual fee and I’ve already received $450 in “free” travel through this card.

Note, you have to transfer your points from Chase directly to Hyatt to utilize these redemption rates – which is really easy to do through the portal.

- Discounted points redemptions through the Ultimate Rewards travel portal. Even if you don’t want to deal with transferring points to partners, the Chase Sapphire Reserve card gets you a hefty 50% discount when you book travel on points through their portal. For example, I recently got a round trip economy fare to Helsinki, Finland for only 35,000 points through the portal. This would have been $525 if purchased directly and a ton of points booked directly through the airline. When points redemptions are this good through the portal, I am willing to make an exception to only purchasing directly through the airline.

- This card also has a “Pay Yourself First” option with various bonus categories that can be an even bigger value than Capital One Venture X – like 25% or 50% bonus redemptions on certain categories of spending. We used this one year to cover a bucket-list dinner at a 3-Michelin Star restaurant.

The Chase Sapphire Reserve also has Priority Pass for the primary cardholder. You can bring two guest and add an authorized user for $75, but the lounge benefits are better through Capital One Venture X, so this is not a perk for me.

Consider the Chase Sapphire Preferred Instead

Not convinced the $550 annual fee is worth it? Maybe you don’t spend enough in the travel category to justify it, so consider the Chase Sapphire Preferred instead. With its $95 annual fee, here are some of the key perks you get:

- $50 hotel credit through the portal (so the annual fee becomes $45)

- 25% discount on travel purchases made through the portal

- 2x points on travel purchases (but you’d get that anyway on the Capital One Venture X)

- 3x points on dining, streaming services, and online groceries

- 10% anniversary points boost

If you don’t care about lounge access or already have it through Capital One Venture X, the Chase Sapphire Preferred is the perfect card for most people. It’s also a great beginner card into the points and miles world because it doesn’t have a big annual fee. If you do care about lounge access you can combine this card with the Capital One Venture X, easily cover $450 of the $490 in annual fees through the travel portals, and still access Chase Sapphire’s bonus categories and Ultimate Rewards Hyatt, Southwest, and United transfer partner programs.

Conclusion

You should note that these cards have other perks that I didn’t mention, either because I don’t personally use them (Peloton), they are temporary (Lyft stuff with Chase – but I do get a lot of value out of this), or they are infrequent (TSA/Global Entry fees). Take a look at the benefits for these cards to see what makes the most sense for you.

If you have an amazing Centurion Lounge at your airport but no Capital One lounge, that will definitely influence your choice. You should also check out the travel insurance and other benefits that could mean a lot to you.

For me, I charge all travel and dining to the Chase Sapphire Reserve and everything else to the Capital One Venture X. That’s the easiest way for me to keep things simple and accumulate points. It also keeps my everyday spending and my travel and entertainment budget separate and easier to track.

Do you have a favorite travel credit card or combo? Let us know in the comments!

Read More of Our Travel Tips and Reviews

- Is SAS Business Class Worth It? An Honest Review

- Cheap Premium Economy Flights to Europe: 3 Ways to Save Big With “Budget Luxury” Options

- Our 10 Favorite Airbnbs Around the World You Can Still Book Today

- Is Turkish Airlines Business Class Worth It? 6 Things We Love and 1 Thing We Hate

- Paris on Points: How This Sign-Up Bonus Can Fund Your Budget Trip

- Best Travel YouTube Vloggers: Our 16 Favorite Channels

Discover more from LiAnn and Theo Travel

Subscribe to get the latest posts sent to your email.

Great write up! didn’t know Capital one can add multiple authorized priory pass users. how about travel insurance? I need to look that up to see if it’s competitive. thanks!

Thank you! The multiple authorized priority pass users is huge! I haven’t done a deep dive into the C1VX insurance yet. I know CSR offers some of the best so I’ll have to compare.

I’m going to get the venture this year because of you? Care to share any referral codes for family and friends?🥰

It’s such a great card. And absolutely! I’ll send you the friends and family referral link so I can get a bonus. Thanks so much!!!